DEEP TECH FUNDING ADVISORY

Our clients are tackling the most pressing issues of our times.

We get them the funding they need to succeed.

Helping extraordinary ventures find institutional capital to bring world-changing innovations to market.

Applying investor standards to the most selective European funding instruments.

Strict ‘no-win, no-pay' policy to ensure complete alignment with our clients.

Backing Europe’s technological champions

Europe’s flagship deep tech funding schemes offer ample, long-term capital to early-stage companies that are expected to become major players in the future.

DEVELOPMENT

TRL4 to TRL6

Transition

€2,5M Grant

Seed

MARKET ENTRY

TRL6 to TRL9

Accelerator

€12,5M Grant & Equity

Series A/B

SCALING UP

Any TRL

Step Scale-up

Up to €30M Equity

Series B/C

EXPANSION

TRL9 +

Venture Debt

€15M to €50M Debt

Series C/D

EIC Transition

Transition funds the development of early scientific results into commercially viable technologies to help research move toward market readiness.

EIC Accelerator

Europe’s €10bn venture fund supports laureates through grants and equity for market entry and scaling up activities.

EIC Step Scale-Up

STEP provides equity financing through the EIC Fund to help deep-tech ventures accelerate industrial deployment and commercial scale.

EIB Venture Debt

The European Investment Bank’s large loan facility for high-growth tech companies needing capital to scale with limited equity dilution.

Deep Science, Strong Patents.

We partner with exceptional teams engineering breakthrough science into industrial-grade technology.

High-risk, capital-intensive innovations with strong IP across multiple sectors are what we are looking for.

INDUSTRIAL TRANSITION

Alt. Energy Production & Storage, Clean-Tech, Climate-Tech, Novel Foods, Agriculture

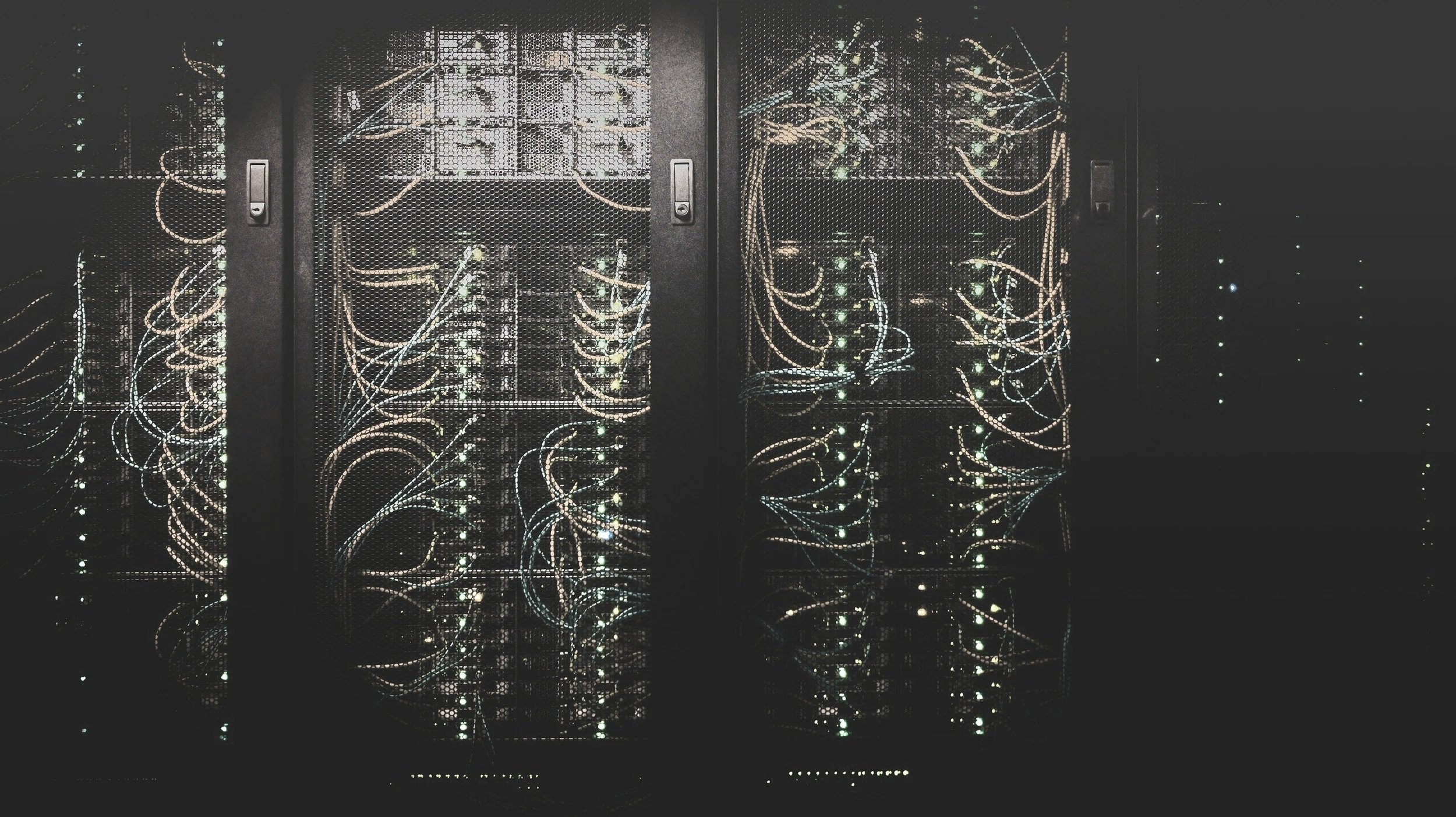

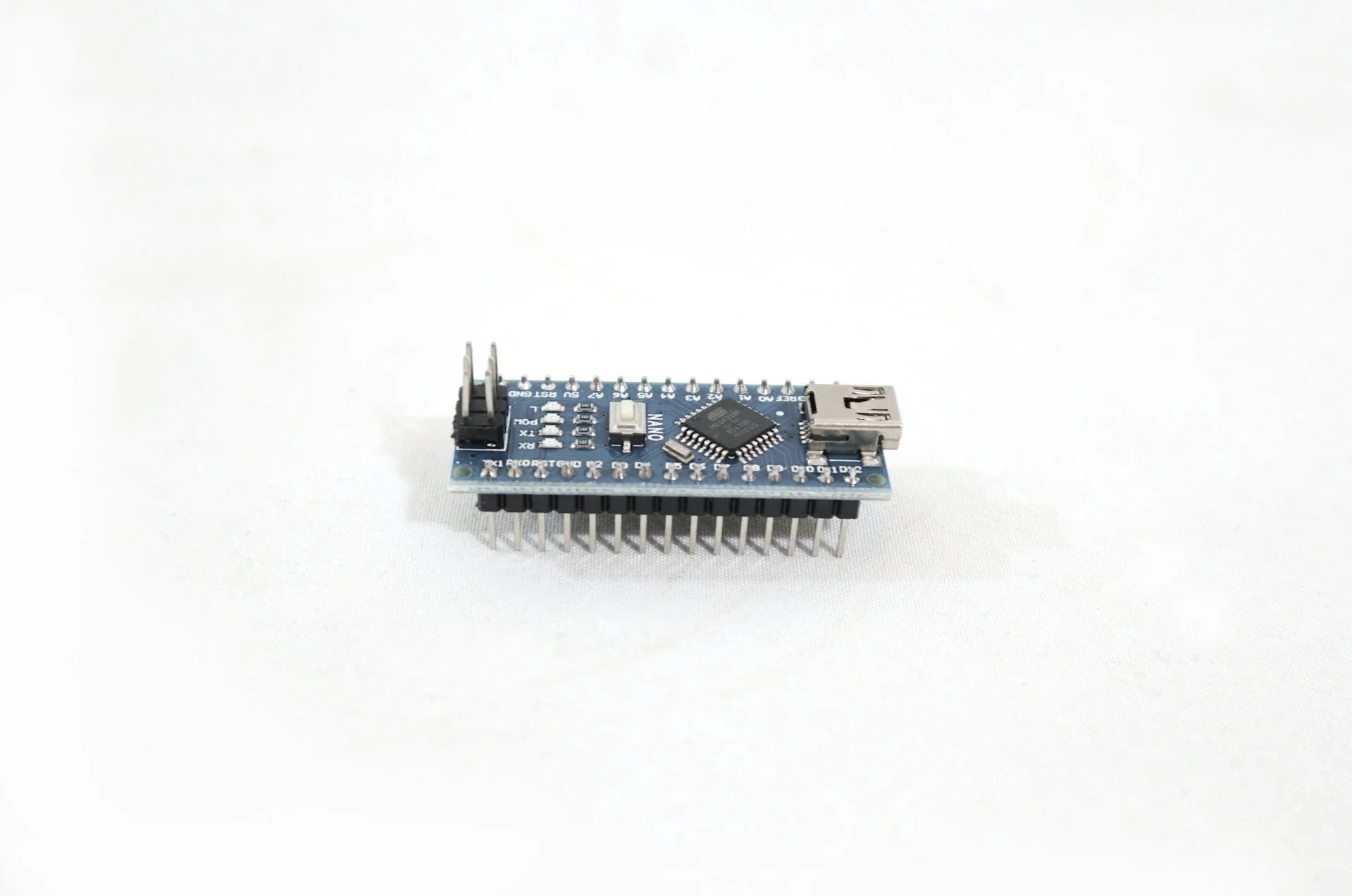

STRATEGIC AUTONOMY

New Space & Aeronautics, AI, Quantum Computing, Dual-use, Cyber Security, Semiconductors, Defence

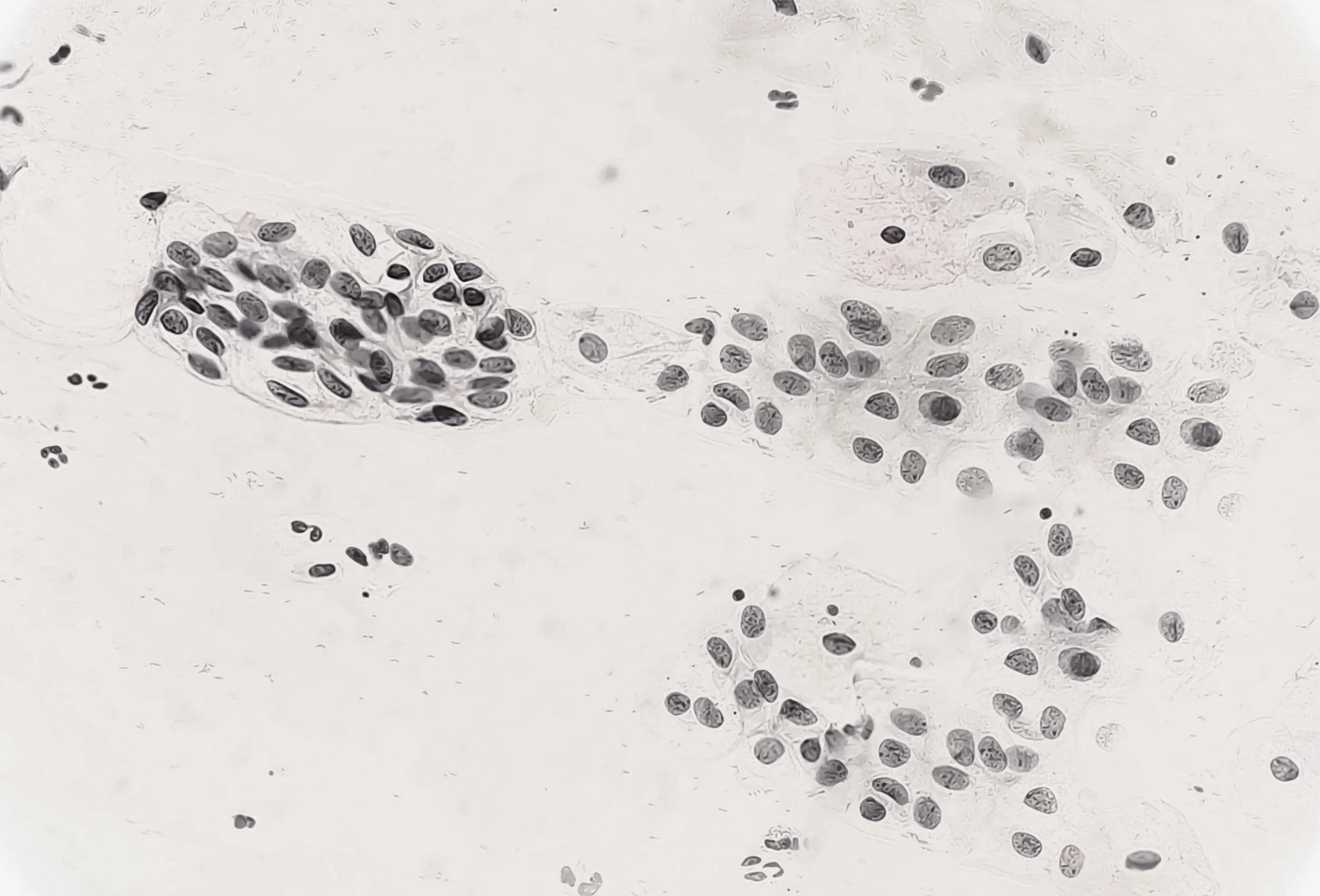

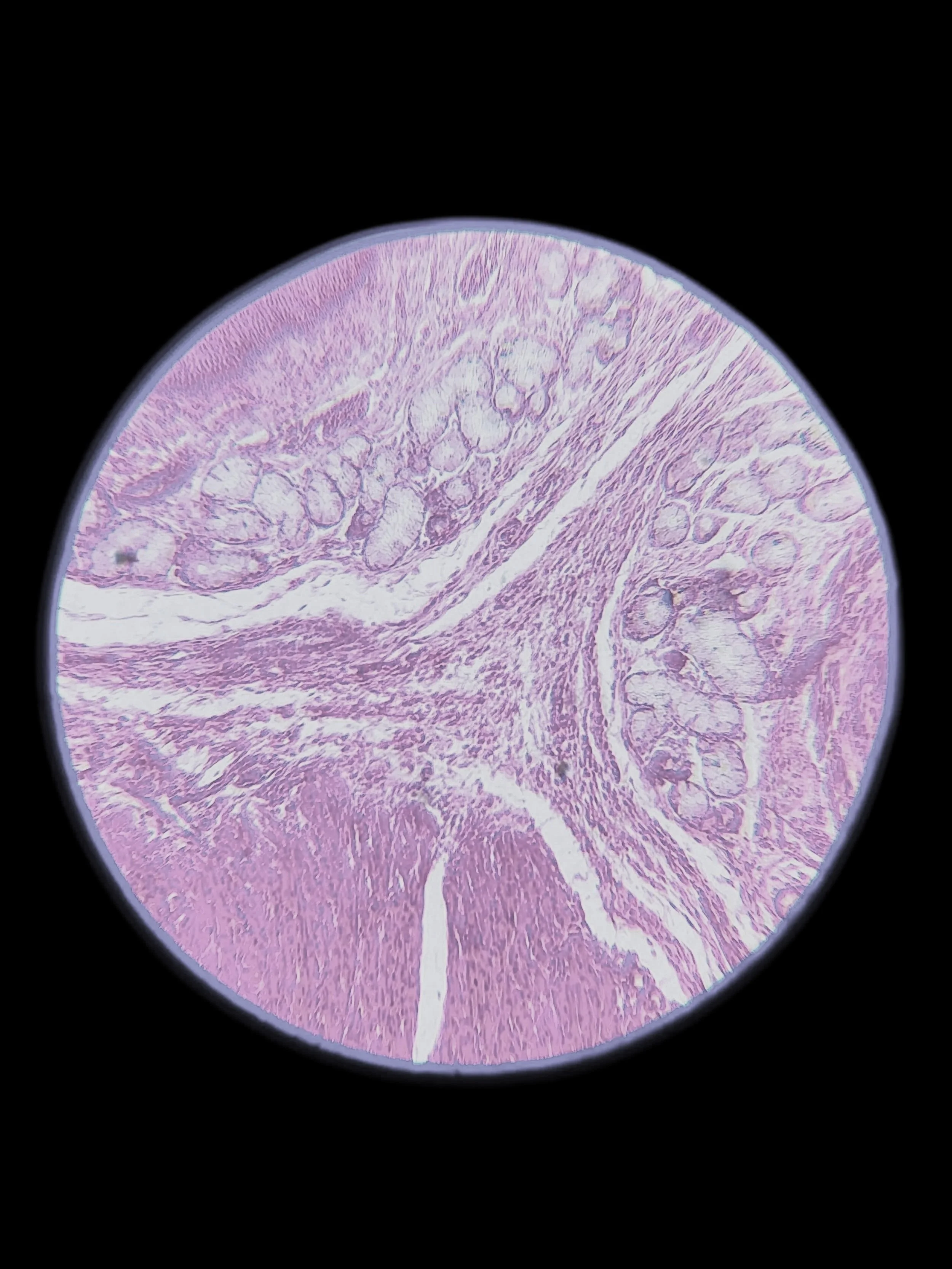

ADVANCING HUMAN HEALTH

Cell & Gene Therapies, Infectious Diseases, Clinical Trials, Drug Development

We assume the risk.

No-win, no-pay with no upfront fees. We’re paid when funding is received.

We are dilligent. We review thousands of companies each year and only engage when we see a viable path to success.

We are deeply committed. We spend thousands of hours per mission conducting technical validation, strategic framing, financial case building, and hands-on negotiation management to support our clients.

We have a track record with the world’s most competitive public venture funding instruments.

About us

Funding advisory based in Brussels.

Founding members of the European Association of Innovation Consultants, uniting leading firms to promote transparency, fairness, and higher standards across public funding programmes.

We adhere to the EIC Code of Conduct, ensuring independence, transparency, without conflicts of interest.

Leadership team

Louis PAPAEMMANUEL

Founding Partner

Matilde MASCIULLI

Partner

Victor WARHEM

Partner